Furniture Financing for Beginners

Wiki Article

The Best Guide To Furniture Financing

Table of ContentsFascination About Furniture FinancingThe Of Furniture FinancingThe Only Guide to Furniture FinancingThe Greatest Guide To Furniture Financing

Consequently, the firm needs to cover this short-lived deficit with cash. Temporary financing is used in this case since it is fairly basic to borrow on the short-term, and it is received by the firm quickly. Additionally, it is relatively easy to pay off debt in the short-term.Long term financing is extra attractive for very huge investments that take a long time to pay off. There are not very lots of financial institutions that have sufficient cash on hand to make a car loan that big, also if they actually liked Ford's service plan, however there are millions of investors that each may be willing to get some Ford bonds and also gain interest.

What are the various sorts of company lendings? Business lendings can either be protected or unsafe. A protected finance means that the debtor supplies security if they back-pedal the car loan. An unsecured personal loan, on the other hand, does not need security. There are lots of kinds of budget friendly fundings local business may obtain.

What Does Furniture Financing Mean?

A company credit card is meant for organization usage instead than individual usage and also can aid business owners build credit scores, which can equate into much better finance prices., of the 1,000 tiny service proprietors checked, 50% of women-owned tiny businesses had never ever taken outdoors funding in 2020 or prior to that., it can still be tough for ladies company owners to access capital.If you are a Square vendor or handling with Square, you could be qualified for a car loan through Square Car loans (furniture financing). When you make an application for any kind of kind of financing, here is some of the paperwork a bank or various other lending institution might wish to see: A plan that defines all elements of your company While a lender will likely draw a service credit history report, they may additionally have a look at an individual credit history record if you have very little borrowing background.

A finance application will certainly consist of a specialist resume as a means to give the lender context for the experience you have in the industry you are operating your business in. Each lender has various minimum demands and also certifications for what will certainly make an applicant much more or less qualified, yet they typically consist of: In this instance, credit score refers to the credit reliability of an organization.

Substantial possessions that could be made use of to protect a important link funding (only in the instance of a protected car loan). The industry of your service is composed of a collection of services that process the very same raw materials, items, or services.

Business finance sizing Company car loan sizing refers to the dimension or dollar quantity of the car loan, and also it can be figured out by several aspects like debt-to-income ratio, credit report, and others. A lending institution identifies the loan sizing that they could be able to supply a customer, but this can be a tricky procedure, as customers might be depending on a larger finance than they might eventually be gotten.

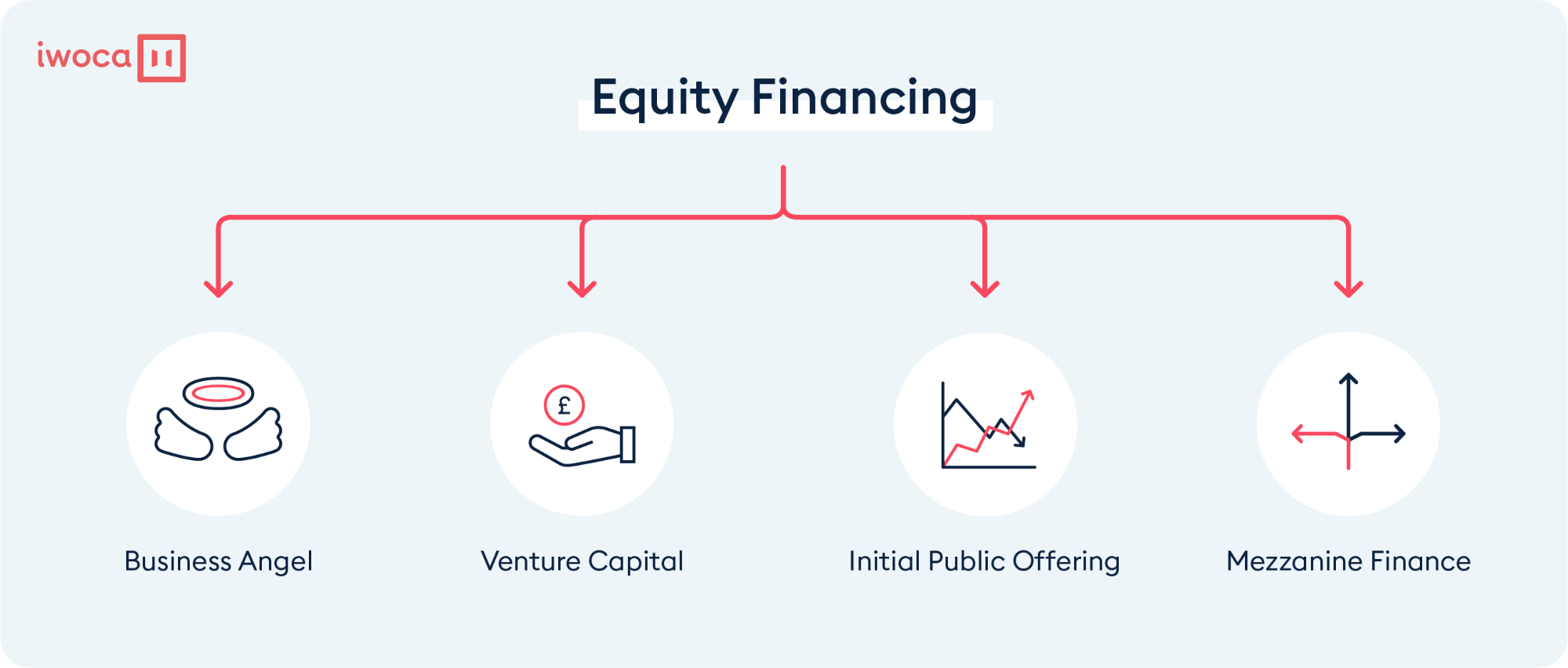

Funding and refinancing organization loans The term "funding" describes the procedure of providing funds for companies. There are 2 different kinds of funding debt or equity financing. Finances drop right into the financial obligation funding category, which implies they need to be repaid with passion. Lendings have a series of terms, from as short as a few months to as long as 25 years.

Furniture Financing Fundamentals Explained

You may consider refinancing if it allows you to lower the rate of interest or shorten the terms of the car loan, and it can be related to a home mortgage or an automobile funding also. Some company lending terms to recognize Below is a reference of financial terms and also meanings that you need to understand in order to make informed options around lendings.This describes impressive billings a business has or, extra extensively, the cash customers owe the company. Accounts payable is cash owed by a company you can look here to suppliers or suppliers. Amortization refers to spreading out repayment over multiple periods. Amortization can describe car loans or properties. An amortized lending needs the debtor to make scheduled, regular settlements put on both the principal as well as passion.

In another feeling, it is the amount the borrower is billed for the finance revealed as an annual price. A lien is a legal right or insurance claim against properties that are utilized as collateral to please a financial obligation. Liens can take several kinds depending on the kind of asset: a financial institution lien, judgment lien, auto mechanic's lien, real estate lien, and see here now also much more.

Report this wiki page